Shopify Stock: A Comprehensive Analysis

Shopify is a leading e-commerce company that provides an online platform for merchants to build and manage their online stores. It has grown to become a dominant player in the e-commerce industry, with a market capitalization of over $180 billion. In this article, we will conduct a comprehensive analysis of Shopify’s stock, taking into consideration various factors that could impact its future performance.

Overview of Shopify’s Business Model

Shopify’s business model revolves around providing a platform for small and medium-sized businesses to build and manage their online stores. It generates revenue through subscription fees, transaction fees, and other supplementary services.

Shopify’s subscription fees are its primary source of revenue. These fees are charged to businesses that use the platform to build and manage their online stores. The fees vary depending on the level of service, with more advanced plans costing more.

Transaction fees are charged to businesses for every transaction that is made on their online store. The fees vary depending on the payment method used, with credit card transactions attracting higher fees.

In addition to these primary revenue streams, Shopify offers supplementary services that include payment processing, shipping, and marketing tools. These services provide additional revenue streams for the company.

Analysis of Shopify’s Financial Performance

Shopify’s financial performance has been impressive in recent years. Its revenue has grown consistently over the past five years, with a compound annual growth rate of over 60%. In 2020, Shopify reported revenue of $2.93 billion, representing a year-over-year increase of 86%.

Shopify’s gross profit has also grown consistently over the past five years, with a compound annual growth rate of over 60%. In 2020, Shopify reported gross profit of $1.54 billion, representing a year-over-year increase of 85%.

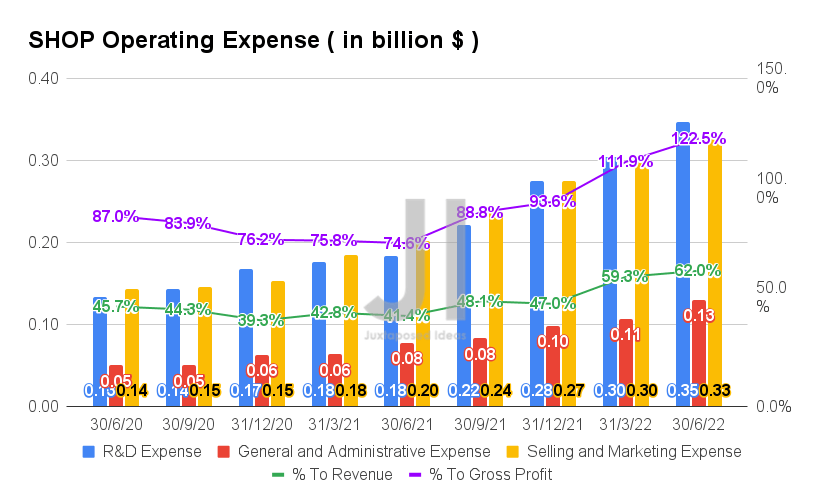

Shopify’s net income, however, has been less impressive. In 2020, Shopify reported a net loss of $124.8 million, compared to a net loss of $31.4 million in 2019. This was due to increased investments in research and development, sales and marketing, and general and administrative expenses.

Despite the net loss, Shopify’s stock price has continued to climb, driven by investor confidence in the company’s growth prospects. In 2020, Shopify’s stock price increased by over 190%, and it has continued to climb in 2021.

Factors Affecting Shopify’s Future Performance

Several factors could impact Shopify’s future performance. These include:

- Competition: The e-commerce industry is highly competitive, with several players vying for market share. Shopify faces competition from established players such as Amazon and eBay, as well as newer players such as BigCommerce and WooCommerce.

- Economic conditions: Economic conditions could impact Shopify’s future performance, particularly in the short term. Economic downturns could lead to reduced consumer spending, which could negatively impact Shopify’s revenue.

- Platform innovation: Shopify’s success has been largely driven by its ability to innovate and provide new features and services to its users. Continued innovation will be critical to maintaining its competitive edge.

- Regulatory environment: Changes in the regulatory environment, particularly with respect to data privacy and security, could impact Shopify’s future performance.

Conclusion

Shopify’s stock has been on a remarkable run over the past few years, driven by impressive revenue and gross profit growth. While the company has reported net losses, investors remain bullish on its growth prospects. However, the e-commerce industry is highly competitive, and economic conditions could impact Shopify’s future performance. Continued innovation and adaptation to changes in the regulatory environment will be critical to maintaining its competitive edge. Overall, Shopify is a company with a promising future, but investors should be aware of the risks and uncertainties that come with investing in any stock