Forex brokers, also known as retail forex brokers or currency trading brokers, are intermediaries that purchase and sell currency pairs in exchange for a commission. A broker can be viewed as either a financial services practitioner or as a salesperson who specializes in the sale of assets. Since the dawn of the modern trading era, the job of the broker has been prevalent in a variety of markets, including equities, commodities, derivatives, and even the insurance and real estate industries.

And, before the start of the internet age, the vast majority of brokers conducted their business over the phone. Clients may place trading orders over the phone, and brokers would purchase and sell assets on their clients’ behalf in exchange for a percentage-based compensation.

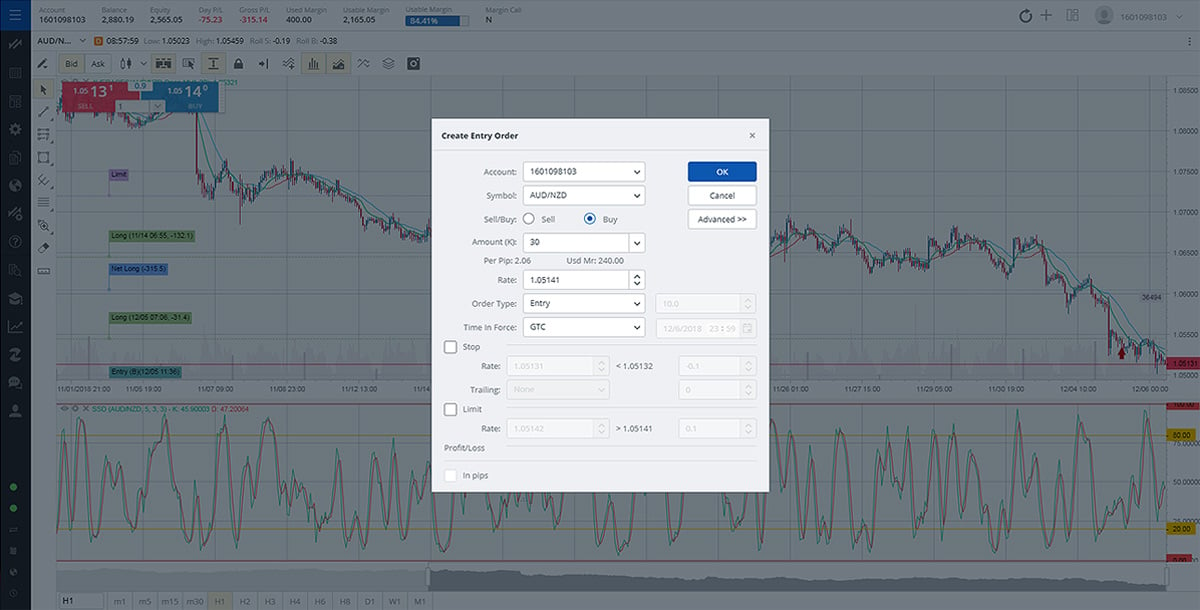

Trading Platform On FXCM Broker

FXCM traders have access to four different trading platforms, demonstrating that the company has established itself as a market leader in this sector. In addition to being FXCM’s most excellent entryway to the financial markets, the company’s exclusive FXCM Trading Station may also be one of the greatest trading platforms available on the market.

A charting package, extensive support for automated trading systems, advanced indicators, and market data are all included at no additional cost. FXCM has created a first-rate trading platform that is easy to use. Before starting trading with an FXCM broker, it is a must to know all about the fxcm review.

Additionally, the MT4 trading platform is offered at FXCM. Many brokers turn a blind eye to the tens of millions of traders that rely on the MT4 infrastructure for their trading activities, but this is not the case at this particular brokerage.

MT4 must be upgraded through the use of third-party plugins, and more than 2,000 free ones are accessible at FXCM, as well as 700 additional ones that may be purchased. As a result of the platform’s expanding popularity, the number of users continues to rise.

The real-time updates and notifications provided by FXCM can be used to inform live traders’ trading decisions, and the FXCM analytics provides a wealth of information and insight into trading behaviors.

Trading with an Active Trader account at FXCM requires a minimum deposit of $25,000 in the currency of choice. Clients benefit from cheaper commissions on trades as well as access to a knowledge base tailored for traders at a more professional level of expertise.

During our investigation for this FXCM review, we conducted a thorough investigation of the FXCM online broker. For the purpose of providing information to both novice and experienced traders, we have outlined the advantages, benefits, and downsides of FXCM.

However, before continuing with the review, readers should be aware that trading CFDs has a significant level of risk. They should seek expert guidance on Forex and CFD trading from financial specialists or financial services, which we strongly recommend.

FXCM provides an economic calendar, and via the use of the demo feature, traders can evaluate the difference between the predicted value and the actual value in order to build trading techniques for real-world transactions. FXCM also provides a trading platform. This demo option is also available to experienced traders and experts who wish to experiment with different trading techniques.

Trading forex and CFDs is a high-risk undertaking that frequently results in user accounts losing money. We recommend that consumers start with a demo account rather than a real-time trading account in order to better understand the risks involved and how to mitigate them. You can also judge whether the FXCM broker is good or not based on the fxcm rating.

This account is better suited for traders with a lot of experience. As a sophisticated trading account, it offers access to all of the services that FXCM has to offer. In addition, the active traders’ accounts are distinguished by the fact that users receive expert guidance from some of the world’s leading forex trading analysts. As an additional benefit to traders, the broker provides a free active trader account with dedicated customer service as well as API trading and Trading Station.

Conclusion

Overall, Alpari was deemed to be an affordable, trustworthy brokerage firm offering competitive trading conditions, minimal spreads, and a diverse range of assets to choose from. Furthermore, they offer some of the most appealing Forex leverage levels available, as well as the most cutting-edge trading technology to help them succeed in their endeavors. They have a reasonable level of support, as well as a variety of different tools and bonuses.